For many people, joining the middle class feels like a milestone. A steady paycheck, a comfortable home, a car in the driveway, and maybe a vacation each year. But beneath the surface, the middle-class lifestyle often comes with hidden money traps that keep families stuck living paycheck to paycheck. If you want to break free…

Maximize Your Retirement Savings: Take Advantage of Your Employer Match

When it comes to saving for retirement, few opportunities are as valuable—or as overlooked—as the employer match on your workplace retirement plan. If your company offers a 401(k) match or similar benefit, not contributing enough to get the full match is like leaving free money on the table. In this post, we’ll cover what an employer match is,…

The Importance of Saving for Retirement Early

When you’re in your 20s or 30s, retirement might feel like a lifetime away. With student loans, rent, and everyday expenses, setting aside money for something decades down the road can seem impossible—or even unnecessary. But here’s the truth: the earlier you start saving for retirement, the easier and more rewarding it will be. 1….

10 Things People Waste Money On — And How to Stop

Managing money isn’t always about making more — often, it’s about cutting unnecessary expenses. Many of us unknowingly spend hundreds (or even thousands) of dollars a year on things that don’t truly add value to our lives. The good news? Identifying these money leaks can help you save big without feeling deprived. Here are 10 common…

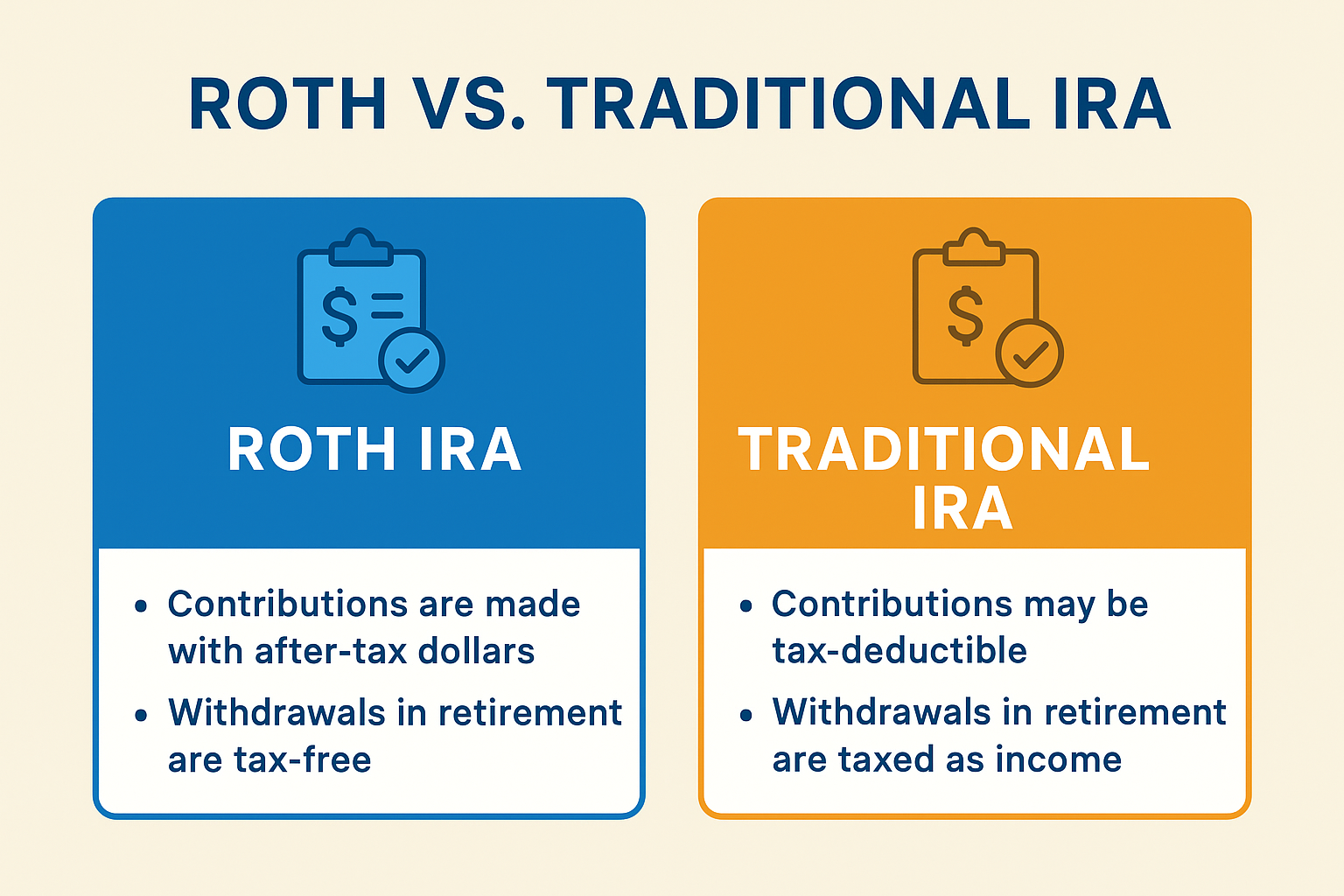

Roth vs. Traditional IRA: Which One Is Right for You?

Planning for retirement can feel overwhelming, but choosing the right type of Individual Retirement Account (IRA) is one of the best ways to start building long-term wealth. Two of the most popular options are the Roth IRA and the Traditional IRA. Both accounts offer tax advantages—but in very different ways. This guide breaks down the key differences between Roth and Traditional…

How to Create an Easy Personal Budget

If you’ve been wondering how to create a personal budget that’s simple and effective, you’re not alone. Budgeting doesn’t have to be complicated or overwhelming. With the right approach, you can build an easy personal budget to help you save money, pay off debt, and take control of your finances—without giving up everything you love. This step-by-step guide will show…

Automating Your Personal Finances: Set It and (Mostly) Forget It

Managing money doesn’t have to be a daily grind. If you’ve ever felt overwhelmed trying to budget, pay bills, save, or invest consistently, there’s good news: you can automate much of your personal finances and free up mental space for things that matter more. Welcome to the world of financial automation — where your money works…